Taiwan Company Registration FAQs

Including of company registration, trademark registration, import and export license, special industry permit applications. After being setup, provide accounting payroll tax compliance services supported by cloud systems.

E-mail: hou2tw@evershinecpa.com

or

Contact by phone in working hours of Texas time zone:

The Engaging Manager Ian Lin, well-English speaker

Tel: +1-510-996-2685

Call us during office hours (Taipei and China Time)

Manager Jerry Chu, USA Graduate School Alumni and a well-English speaker

Mobile: +886-939-357-735

Tel No.: +886-2-2717-0515 ext. 103

Q: What is the service coverage of Evershine in Taiwan Company Registration?

*Company Registration

*Virtual Registered Address

*Open Banking Account

*Trademark Registration

*Work Permit Application

*ARC (Alien Residence Certificate) Application

*FDA Business License Application

*Healthy and Functional Food Product License Application

*Medical Device Business License

*MLM Business License Application

*Other Special Industry Permit Application

Q: How to know what kind of entity to register?

| With Tax ID? | Issues Sales Invoices? | Legal Entity? | Wholly Owned by a Foreigner? | |

| Representative office | Yes | No | No | Yes |

| Branch | Yes | Yes | No | Yes |

| Subsidiary | Yes | Yes | Yes | Yes |

| Joint Venture | Yes | Yes | Yes | No |

1) Representative Office

1.1 Expenditure payment to company’s vendors and employees & payroll compliance issues handling.

1.2 No need to issue local invoices in your representative office. The sales invoice is directed to the parent company.

2) Branch

2.1 Direct issuance of sales invoice to the client by your branch.

2.2 Payment of expenditures and inventory purchasing.

2.3 Not a legal entity; acts on behalf of the parent company.

3) Subsidiary

3.1 It is a legal entity and independent domestic company.

3.2 To issue sales invoice, pays out all expenditures and purchase inventory.

4) Joint Venture

4.1 Same with subsidiary.

4.2 Only difference is that a joint venture would not be a wholly-owned entity by a foreigner, it must have a local partner.

Q: What is the minimum capital of a Taiwan WFOE?

Minimum capital will depend on your working capital based on local CPA’s assessment. In order to avoid trouble if working capital is enough, we always suggest NT$ 300,000 (about US$10,000) which is the current regulation on minimum capital.

As an investor, if you need to have working visa and ARC (Alien Resident Certificate), your minimum capital needs to be more than NT$500,000 (about US$17,000).

Q: Who can be the shareholders and BOD of a Taiwan WFOE?

Shareholders can be 100% owned by foreigner, either individual or company. It is better not have PRC shareholders because it needs to follow up different regulations. Directors can be foreigners or let non-shareholders as a director. Taiwan welcomes foreigners to come here to develop their businesses. Specific regulations apply on a case-to-case basis.

Q: What are the service charges and out-of-pocket expenses?

Your cost of setting up a Representative Office is US$1,500, a Branch or a Subsidiary is US$2,500 plus out-of-pocket expenses are about US$330. If you can prepare the documents needed in the registration process in Chinese by yourself, we can give you a discount. The above quotation does not include the special-permit-application fee. If you need us to arrange a virtual registered office, it will be a one-time charge of NT$18,000 for the first 3 months (about US$600) paid to the owner of the address.

As for application of Work permit, Z-visa, Work Certificate to Resident Certificate, service fee will be charged per person (US$700). If you have dependents, service fee will be = USD700+(applicant number minus first one)*USD300+Government fees (RMB2000= US$333) for each applicant.

Out-of-pocket expenses: these will be caused by handling your company’s set up including transportation, stamp, express, etc.

Final fee schedule will be up to signed Engagement Letter.

Q: How can Evershine serve clients? What are the processes?

One of our staff (a well-English speaker) will attend to your concerns. If needed, a native English speaker will communicate with you. We always work with potential clients according to the following steps:

Client Provides Requirements –> Client Consultation –> Engagement —> Registration Work Starts.

Evershine will provide you general information, if thorough research is required, there will be an additional charge of US$100 per hour.

Based on our internal SOP, we need to do so-called KYC (Know your Client) to assure if we are fit to serve you.

Engagement Letter will include detailed procedures, required documents, service fee and out-of-pocket expenses, etc.,

After your signing of Engagement letter, a retainer fee will be required.

Then, our staff will execute registering procedures.

During registration period, we will use BPM (Business Process Management) system to monitor service delivery time and documents quality.

Once the company’s registered, we will bill your final service fee and out-of-pocket expenses.

Q: After obtaining company license, what kinds of services Evershine can provide?

After-Set Up Cloud Accounting, Tax and Payroll Compliance services listed below:

*Accounting service using Cloud collaboration system

*Cashier role as ” Maker” in your internet-banking account

*China Tax Compliance services

*Payroll Compliance services

We will act as your in-house accountant in your Taiwan subsidiary

When you adopt our services, we will use our proprietary Cloud platform to build a collaborative work environment among your staff and Evershine’s.

Any authorized person may key-in, review, approve and inquire anytime, anywhere. We will act as your in-house accountant in your China subsidiary. No recruitment needed!

We use BPM (Business Process Management) system to monitor service quality including of on-time delivery and correctness. Our business model has been providing very high quality services at a very competitive cost. Several hundreds of MNCs (multi-national-company) are our clients. Client list will be provided upon request.

If you want to have more information, please don’t hesitate to contact us. You may also click the link to visit the website & learn more: https://hou.evershinecpa.com/taiwan-wfoe-accountant

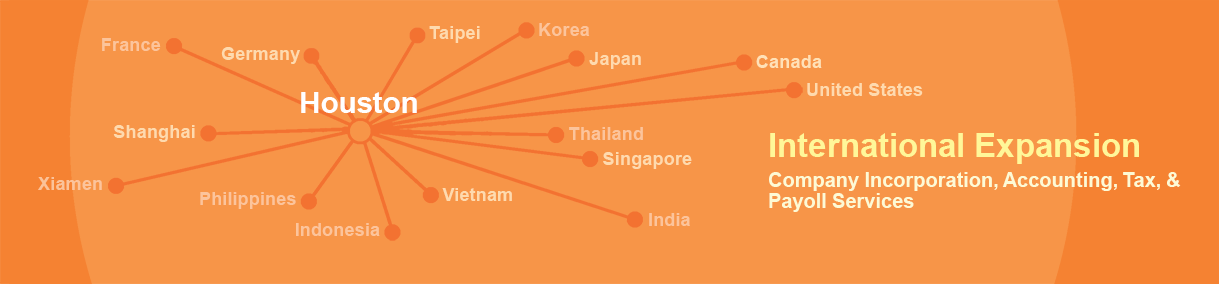

Q: Can Evershine provide similar services in other cities?

Evershine CPAs Firm has its 100% owned offices to provide services in different cities listed below:

Taipei, Beijing, Shanghai, and Xiamen, Hangzhou, San Francisco, Seoul, UAE

We have been providing our services with our partners in below cities:

Kaohsiung Taiwan, Singapore, Hong Kong, Seoul Korea Tokyo Japan, Hangzhou China,

Nanjing China, Guangzhou China, Kuala Lumpur Malaysia, San Francisco USA

We can arrange co-serving partners for other locations not mentioned above, please click the links to find out more: IAPA Member Firms of IAPA and LEA Member Firms of LEA.There are many Evershine CPAs Firm associates around the world. We have around 980 firms with 38,000 employees in about 450 cities. If your firms are located in the above-mentioned cities, we can serve you right away.

Please send email to HQ4hou@evershinecpa.com

Q: Where is the Taipei office of Evershine?

Evershine CPAs Firm Headquarters

6th Floor 378, Chang Chun Rd., Taipei City, Taiwan R.O.C.

永輝啓佳聯合會計事務所

地址:104臺北市長春路378號6樓

靠近長春路與復興北路交叉口

捷運文湖線南京東路站,兄弟大飯店附近

Office Telephone: +886-2-27170515

Q: How to expedite Taiwan Company Registration process?

Please send an email to hou2tw@evershinecpa.com with answers to below questions:

1) What is your business category? Is it Service, Consultation, Trade or Manufacture?

2) What are your business items? We need to assess if it requires special permit industry.

3) What is your business model? What is your revenue source? Please send a link to your website.

4) How are your shareholders composed? Where is your parent company established? Are the shareholders companies or individuals?

5) Do you have your own registered address already? If not, how much time do you need to locate your own address? Do we need to arrange a virtual registered office for you during the initial period?

6) What are your company phone numbers and your personal phone number? We may discuss over the phone, if necessary.

Contact Us

e-mail: hou2tw@evershinecpa.com

or

Contact by phone in working hours of Texas time zone:

The Engaging Manager Ian Lin, well-English speaker

Tel: +1-510-996-2685

Call us during office hours (Taipei and China Time)

Manager Jerry Chu, USA Graduate School Alumni and a well-English speaker

Mobile: +886-939-357-735

Tel No.: +886-2-2717-0515 ext. 103

For investment structure relevant with multi-national tax planning and Financial & Legal Due Diligence for M&A (Merge and Acquisition), send an email to HQ4hou@evershinecpa.com & contact Dale Chen, Principal Partner/CPA in Taiwan+China+UK, AIA, & over-all responsible for these arrangements.

linkedin address:Dale Chen Linkedin

Other references