Due Diligence for M&A Project in China hou2cn

E-mail: hou2cn@evershinecpa.com

or

Contact by phone in working hours of Houston time zone:

Contact by phone in working hours of Texas time zone:

The Engaging Manager Ian Lin, a well-English speaker

Tel: +1-510-996-2685

speak in both English and Chinese

Mobile: +1-510-813-2463

** **

In Taiwan and major cities of China, we are focused on providing our featured services to overseas entities of these stock-listed parent companies in their own countries.

If you have M&A target and want confirmation on its feasibility, we can cater Due Diligence services.

Evershine CPAs Firm is well-experienced in doing these services and has already handled more than 50 Due Diligence cases assigned by global companies until June 2016.

Among them was a transaction worth 700 million USD.

Service Coverage

*Review Past 3 years financial statements

*5-year financial statement forecast

*EBIDA calculation for your reference

*Tangible Assets Review

*Liability Review

*Share & Loan Capital Structure Review

*Review Intangible Assets

*Tax Risk Evaluation

*Guarantee to bear past tax risk of Target Company, if necessary

*Contingent Liability Evaluation through Execution of Legal Due Diligence procedures

*Feasible and workable Deal Structure Suggestion

*Review IT and Internal Control System

*After-merger Assistance for better control through cloud collaboration in the IT system

Why does the merging of local companies in the Greater China area involve high legal or tax risks?

Local companies in Taiwan have a so-called two-book issue.

One book refers to the one shown to the Tax Bureau, which reflects little income, the other is shown to shareholders which reflects real income figures, which are higher than that shown to the Tax Bureau.

That is because the total tax rate will reach a very high percentage (%) of the earned income if a company is to be totally open with its figures.

However, this practice presents very high tax risks.

Therefore, if you want to merge existing local Chinese companies, assigning us to evaluate tax risk is necessary.

You can then evaluate how much risk you are to undertake when merging.

And finally, if you decide to merge target companies but you’re dubious to undertake tax risk,

Evershine can guarantee to bear the past tax risk of Target Company when you assign us to do due diligence.

After-merger assistance for better control through cloud collaboration IT system set up.

How to help your Asian Company to be compliant with local regulations?

We will act as your in-house accountant using our web-platform system to create a collaborative working environment,

which allows us to perform tasks just like an in-house accountant would when recruited by you.

Evershine staff will review every transaction via the cloud system in our own office and see if these are compliant with regulations.

Evershine staff will go to your JV Company and provide consultation when necessary.

Since the staff of the Parent company can jointly review or approve every transaction through our Cloud System,

your WFOE in Asia need not recruit any local accountant, treasury, payroll handler, and IT personnel when adopting our services.

Through our services, you will be very comfortable in controlling merged companies financially.

Contact us

E-mail: hou2cn@evershinecpa.com

or

Contact by phone in working hours of Texas time zone:

The Engaging Manager Ian Lin, a well-English speaker

Tel: +1-510-996-2685

Additional Information

Evershine Headquarter:

Taipei Evershine CPAs Firm/ Evershine BPO Services Corporation6th Floor, 378 Chang Chun Rd.,Zhongshan Dist., Taipei City, Taiwan R.O.C.

Near MRT Nanjing Fuxing Station

Principal Partner /General Manager:

Dale C.C. Chen /CPA in Taiwan+China+UK/ MBA+DBA/ Patent Attorney in Taiwan

Mobile: +86-139-1048-6278

in China ;

Mobile:+886-933920199

in Taipei

Wechat ID: evershiinecpa ;Line ID:evershinecpa; skype:daleccchen ;

Linking Address: Dale Chen Linkedin

Evershine Global Service Sites for Reference:

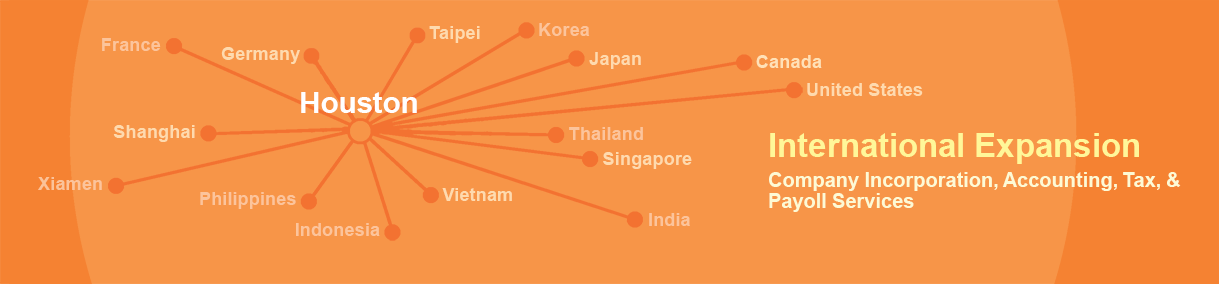

Evershine has 100% affiliates in the following cities:

Headquarter, Taipei, Xiamen, Beijing, Shanghai, Shanghai,

Shenzhen, New York, San Francisco, Houston, Phoenix Tokyo,

Seoul, Hanoi, Ho Chi Minh, Bangkok, Singapore, Kuala Lumpur,

Manila, Dubai, New Delhi, Mumbai, Dhaka, Jakarta, Frankfurt,

Paris, London, Amsterdam, Milan, Barcelona, Bucharest,

Melbourne, Sydney, Toronto, Mexico

Other cities with existent clients:

Miami, Atlanta, Oklahoma, Phoenix, Michigan, Seattle, Delaware;

Berlin, Stuttgart; Paris; Amsterdam; Prague; Czech Republic; Bucharest;

Bangalore; Surabaya;

Kaohsiung, Hong Kong, Shenzhen, Donguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin.

Evershine Potential Serviceable City (2 months preparatory period):

Evershine CPAs Firm is an IAPA member firm headquartered in London, with 300 member offices worldwide and approximately 10,000 employees.

Evershine CPAs Firm is a LEA member headquartered in Chicago, USA, it has 600 member offices worldwide and employs approximately 28,000 people.

Besides, Evershine is Taiwan local Partner of ADP Streamline ®.

(version: 2024/07)

Please contact us by email at HQ4hou@evershinecpa.com

For more Services in more cities please click Sitemap

Other relevant links

>>Taiwan WFOE Company Registration

>>Taiwan WFOE Accountant

>> Due Diligence For M&A Project

>> Taiwan Payroll Compliance

>>Taiwan Temporary Employment Outsourcing

>> Market Expansion Services in Taiwan hou2tw

>> Services in Major Cities in China

>> China Payroll Compliance by City

>> China WFOE Company Registration

>> China WFOE Online Accounting Services

>> China Trademark Registration Services

>> Beijing Setup Payroll Accounting Tax One-stop Services hou2cn.north

>> Shanghai Setup Payroll Accounting Tax One-stop Services hou2cn.east

>> Xiamen Setup Payroll Accounting Tax One-stop Services hou2cn.south